#704,No.2362,Fangzhong Road,Xiamen,Fujian,China,361009 +86-18350098686 [email protected]

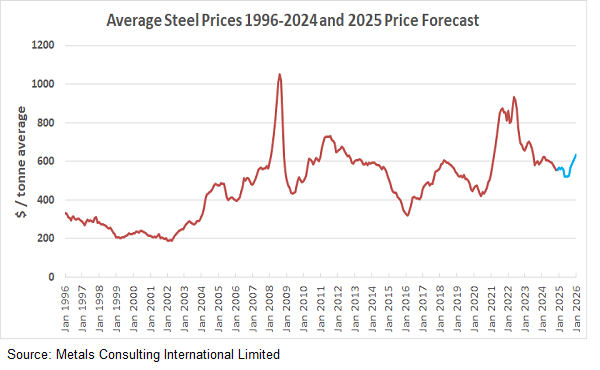

Overview The global steel market is pivoting from a year of consolidation to a period of strategic recovery. After the volatility of the early 2020s, 2025 served as a necessary "reset," establishing a new price floor driven by decarbonization costs rather than raw demand.

2025 in Review: The "Green" Floor 2025 was defined by stability. While global construction demand remained tepid due to high interest rates, prices did not collapse. Instead, the market bifurcated:

Standard Steel: Saw flat pricing as supply chains normalized.

Green Steel: Commanded a steady premium, driven by EU regulations.

China’s Role: A controlled reduction in Chinese export volume helped balance global inventories, preventing a supply glut.

2026 Forecast: A Structural Uptrend Analysts project a bullish but controlled outlook for 2026. Prices are expected to rise by 3-5% year-on-year, driven by three structural factors:

Infrastructure Renewal: Major projects in North America and Southeast Asia are entering procurement phases, boosting demand for long steel and heavy plate.

The Carbon Cost: With Carbon Border Adjustment Mechanisms (CBAM) tightening, the cost of carbon is now permanently priced into imports, raising the floor for international trade.

Energy Prices: Stabilizing energy costs will aid production, but the transition to hydrogen-based reduction will keep operational expenses high.

Summary The era of volatility is giving way to an era of "expensive stability." Buyers should expect a gradual price increase in 2026, driven not by a shortage of material, but by the rising cost of sustainable compliance.